CODEFI DATA

Data and Risk Analytics for Digital Assets and DeFi Protocols

Evaluate DeFi protocol security, token issuance, and digital asset performance with comprehensive data and risk analytics.

Overview

Simplified and synthesized DeFi data

Decentralized finance is growing exponentially. This can make the expanding network of protocols and applications difficult to understand and challenging to monitor. Reliable, simplified, and actionable data is key to inspire investor confidence and alleviate the risks of engaging with crypto funds, traders, and platforms. Enter Codefi Data.

Codefi Data powers DeFi Score, Compare, and Inspect, a suite of data and risk analytics tools designed to help investors understand the risks and trade-offs of deploying capital into the DeFi space.

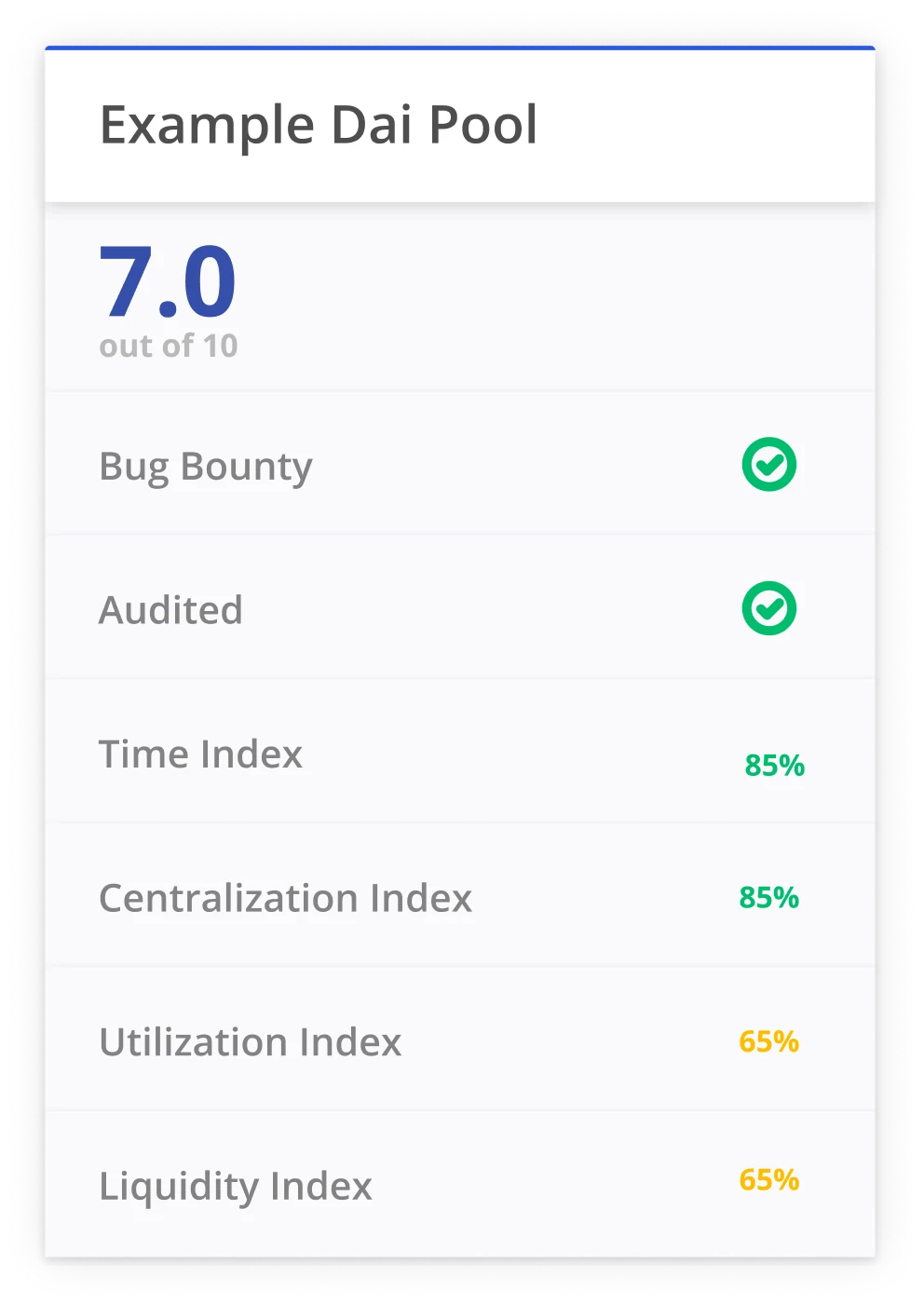

Assess DeFi protocol risk

Risk measurement

Measure factors including smart contract, centralization and financial risk to determine a protocol’s DeFi Score.

Composable framework

Model risk-adjusted returns and educate new users on the risks of deploying capital into DeFi protocols.

Standardized score

Associate DeFi protocols with a 0-10 score based on platform risk, considering technical vulnerabilities, time on the market, and administrative safeguards.

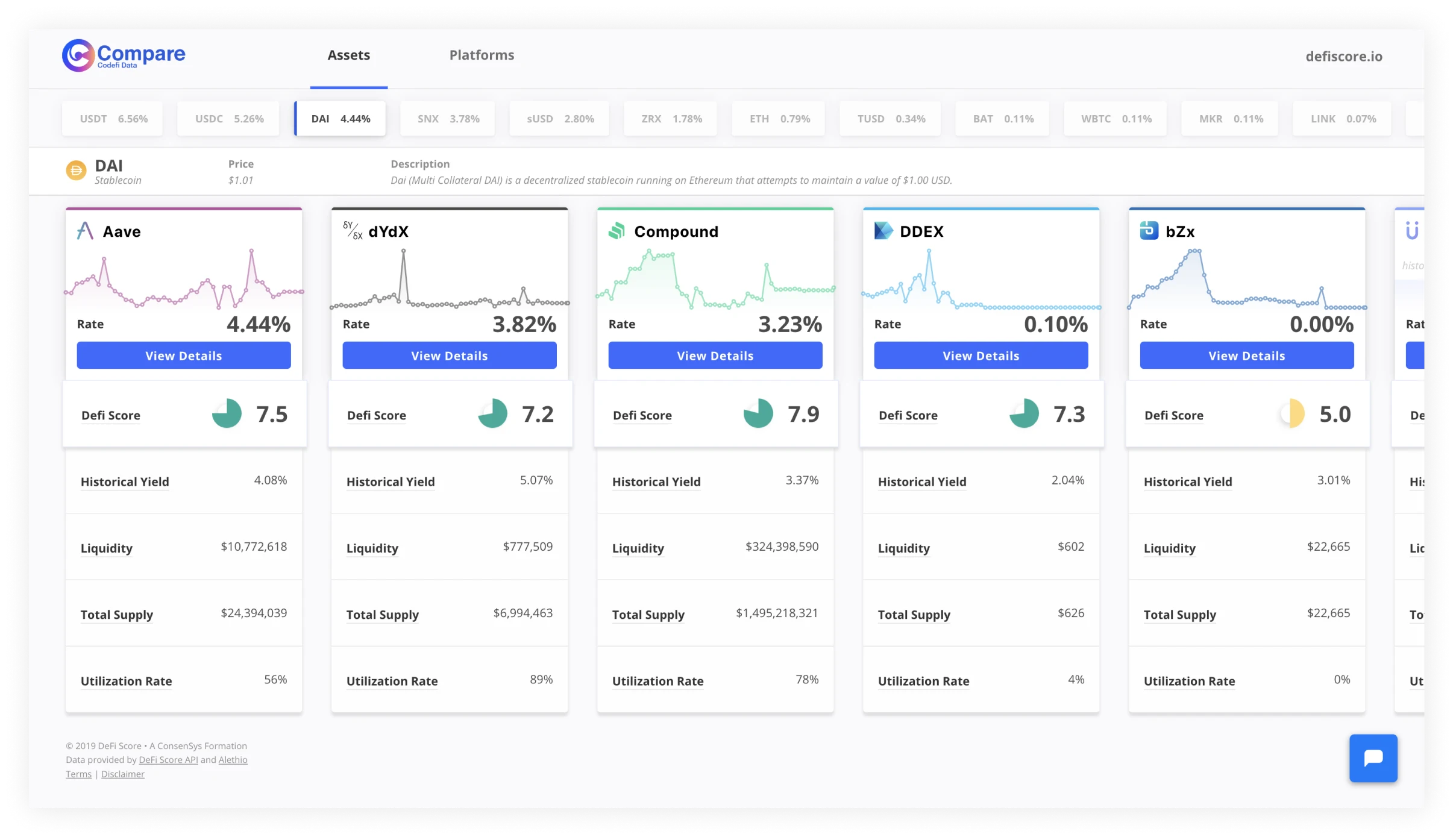

Compare yield opportunities for optimal returns

Digital asset returns

Deposit digital assets into applications to earn a return through lending, market making, insuring, and staking.

Yield comparisons

Evaluate DeFi yield opportunities for total and risk-adjusted returns. Leverage this data to inform capital decisions.

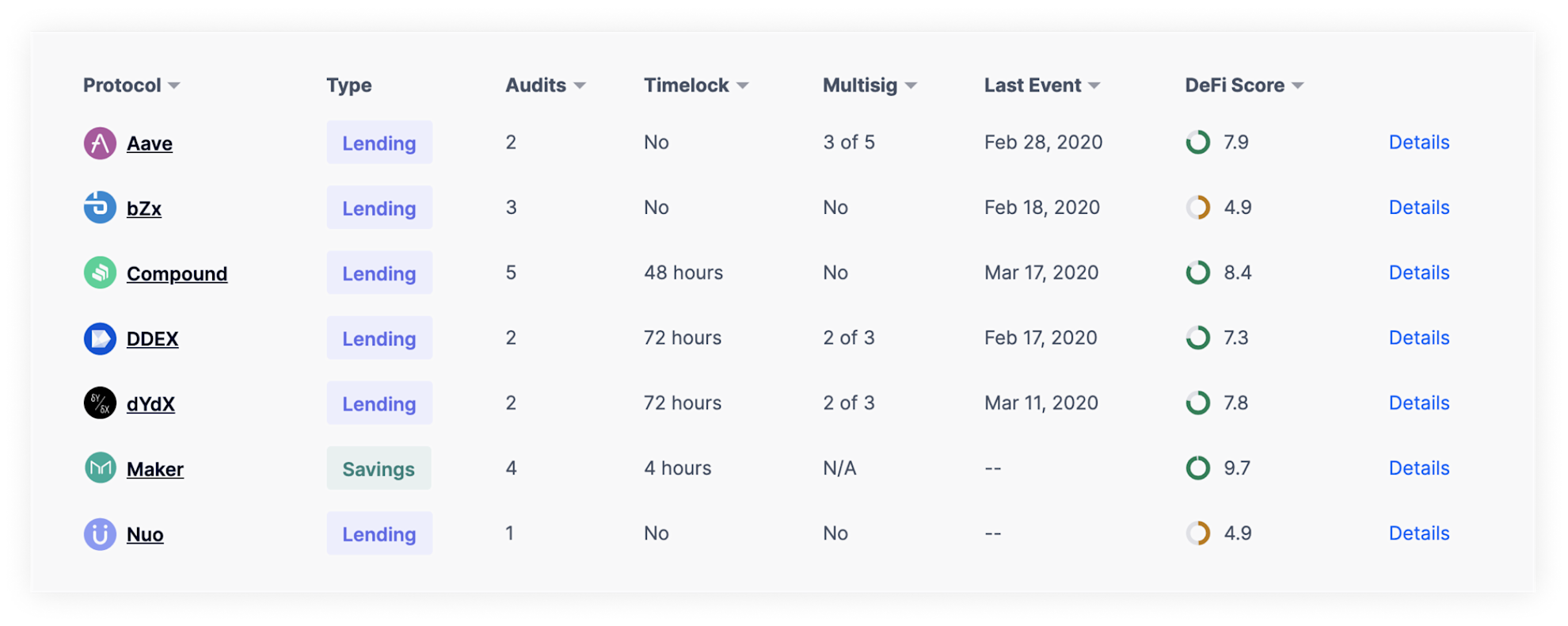

Inspect aggregated metrics across protocols

Protocol transparency

Identify vulnerabilities across top and emerging DeFi applications. Gain visibility into the centralized components that largely determine risk levels, including admin keys and digital asset pricing oracles.

Data monitoring

Inspect public audits, key admin details, oracle dependency, and on-chain activity of top DeFi protocols to inform important decisions.

Grow the DeFi ecosystem

Promote protocol transparency, user adoption, increased participation, and liquidity across DeFi with trusted real-time, actionable data.

"With DeFi Score we have finally been able to build a product offering that satisfies multiple risk appetites, and we believe this will pave the way for other businesses that want to offer a full yield service to their users while maintaining risk levels under control.”

Matteo Pandolfi

Co-Founder of Idle FInance

Trusted, actionable data is the foundation for financial services analysis and decision-making. Pre-trade analysis, asset valuation, portfolio management, trade execution, post-trade settlement, risk management, portfolio processing, performance reporting, and regulation compliance are all driven by machine readable data.

This is equally true for the emerging institutional digital asset and DeFi ecosystem. Now with over $28 billion worth of value locked in Ethereum smart contracts, DeFi is among the fastest growing spaces in blockchain. Crypto funds, crypto traders, lending platform users, staking network participants, and the platforms and transaction venues utilized by these investors all need data. Data remains critical to analyze investment options, create algorithms, find liquidity, execute trades, assess performance, meet compliance requirements, and manage portfolios. For digital assets and DeFi, this data can be difficult to access on- or off-chain. Codefi Data offers easy-to-consume, trusted, and actionable data to power the future of financial services.

While permissionless blockchains are now able to power full financial services, ratings agencies and researchers have not yet started monitoring these products. In response, Codefi Data provides a suite of APIs to measure the risks of these new services. Our technology already enables industry leaders like CoinGecko and Idle Finance to provide risk-adjusted metrics to their users. We partner with financial service leaders as well as Web3 projects to push the ecosystem forward.

Data for the DeFi Ecosystem

RESOURCES AND INSIGHTS

Learn more about DeFi

A review and analysis of DeFi protocols and performance in Q4 2020 by Consensys Codefi.

A recent report commissioned by Consensys Codefi examines user habits with regard to cryptocurrencies and decentralized finance (DeFi).

Here’s your complete guide to the exciting new world of DeFi.