CODEFI ASSETS

Digital Asset Tokenization, Issuance, and Lifecycle Management

Create, issue, and manage the lifecycle of digital assets, financial instruments, and associated markets.

Overview

End-to-End Digital Asset Management

Traditional debt capital markets and asset management face many challenges and inefficiencies—from expensive paper-based processes to multiple intermediaries, disconnected data silos, and slow transaction settlement. These points of friction result in poor data security and sharing, fractured security administration, rising costs, and ultimately, an outdated investor experience.

Codefi Assets is an end-to-end digital asset management platform that securely digitizes a wide range of financial products and transactions.

Operations efficiency

Improve workflows and reduce costs with automated processes and blockchain-native data accessibility.

Asset tokenization

Digitize closed-end and open-end funds as well as debt capital market instruments like zero-coupons, fixed-rate, and floating-rate bonds.

Operations efficiency

Improve workflows and reduce costs with automated processes and blockchain-native data accessibility.

Product Benefits

Monetize a wider range of assets

Tokenize existing financial products

Digitize products including debt capital market instruments, bonds, and asset management instruments. This includes open-end funds (Mutual funds and SICAV units), and closed-end funds (Private equity funds and special purpose vehicles).

Create new financial products

Build on the connectivity between fully digitized assets, associated markets, and financial instruments to form entirely new products and services.

Tailor products to meet market demands

Customize asset issuance directly according to issuer specifications, and restructure slow-settling financial products to quickly react to market fluctuations.

Expand secondary market opportunities

Wide investor access

Make your products accessible to a larger pool of investors by digitally fractionalizing assets, reducing the cost of issuance, and distributing secure, blockchain-based tokens across the globe.

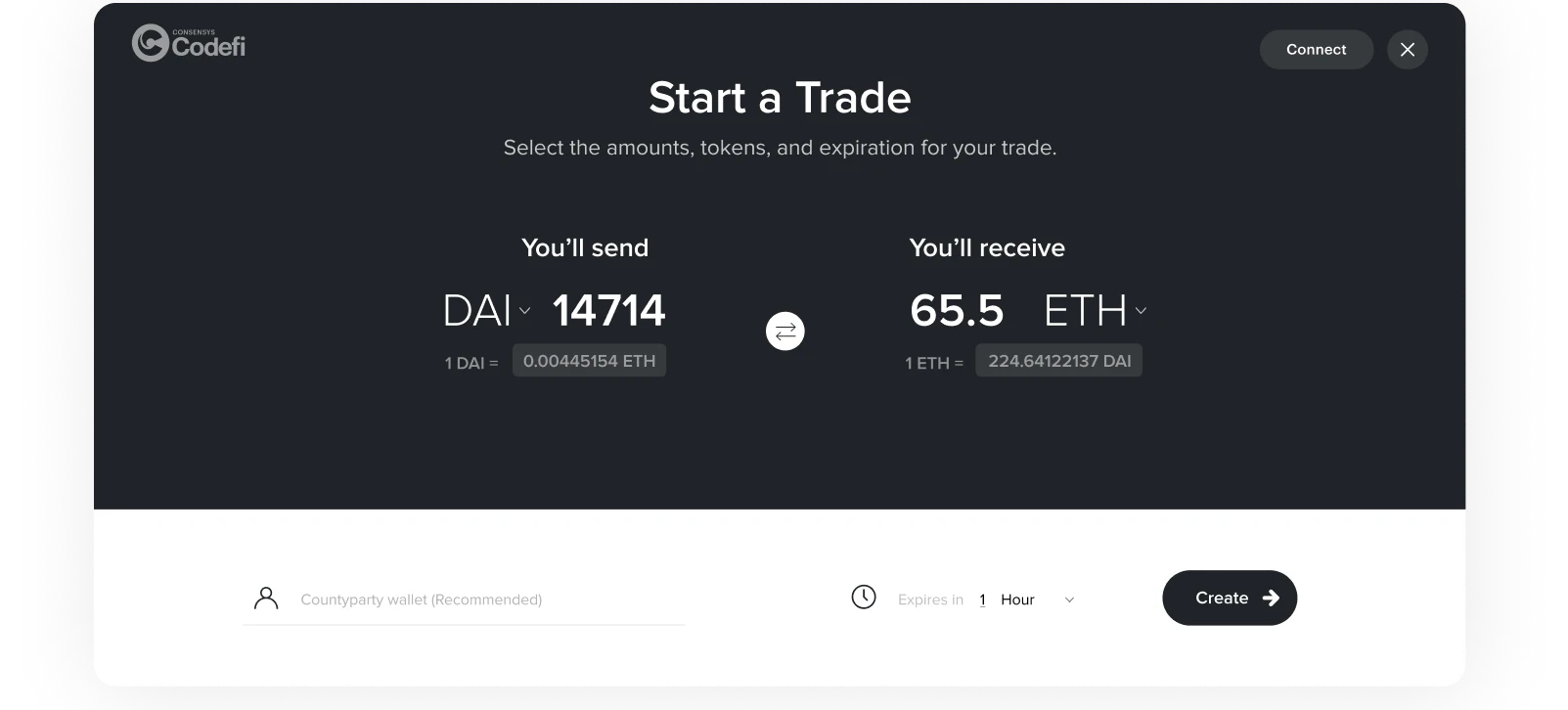

Peer-to-peer trading

Extend your digital asset offering with integrated over-the-counter trading. Unlock liquidity with fast and secure peer-to-peer asset transfers, and enable frictionless trade for your user base.

- No deposits

- No counterparty risk

- Peer- to peer

- Customizable pricing

- Multiple cash options including stablecoin, bank, and card payments

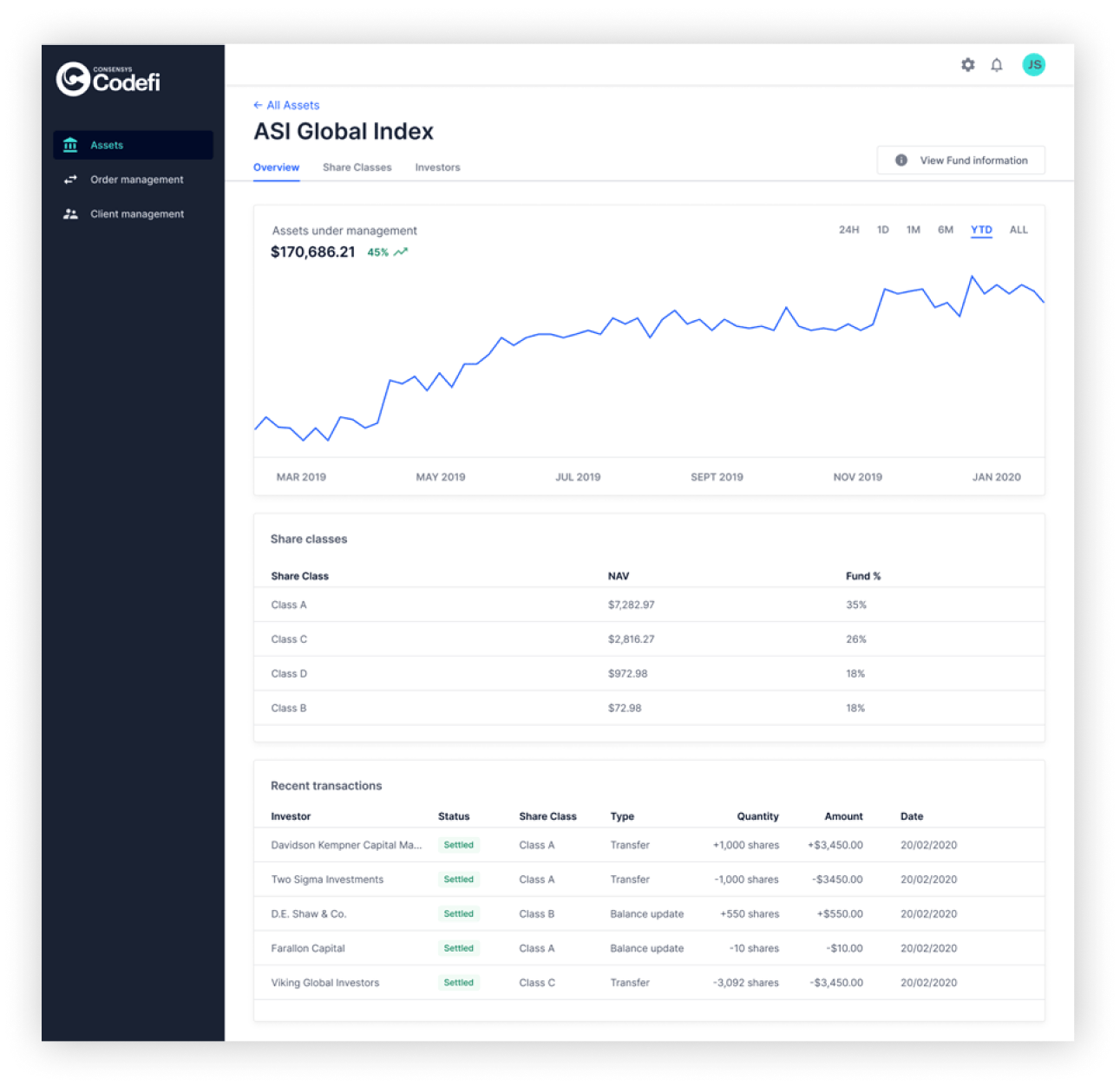

Streamline the investor experience

Interface directly with investors and enable them to purchase assets, view their portfolios, initiate asset transfers, inspect individual assets, and manage shareholder rights all from a single dashboard.

Product Features

Elevate your digital asset management stack for next-generation commerce and finance.

Customizable Issuance

Issue new securities in minutes, with the rights and obligations of issuers and investors encoded and automated.

Built-in Compliance

Ensure your digital assets comply with regulation by utilizing code that is modeled after traditional securities law.

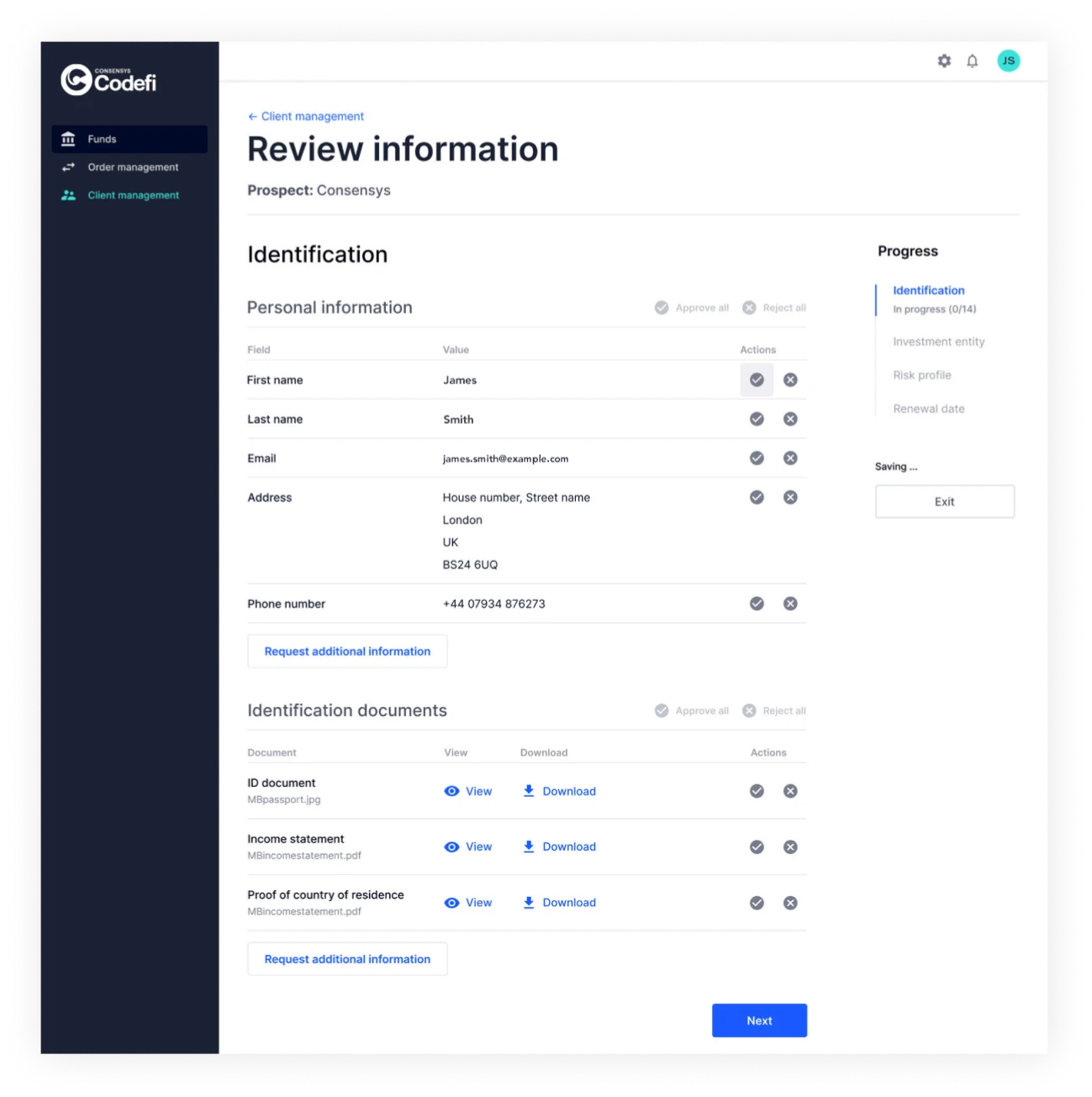

Accelerated Investor Onboarding

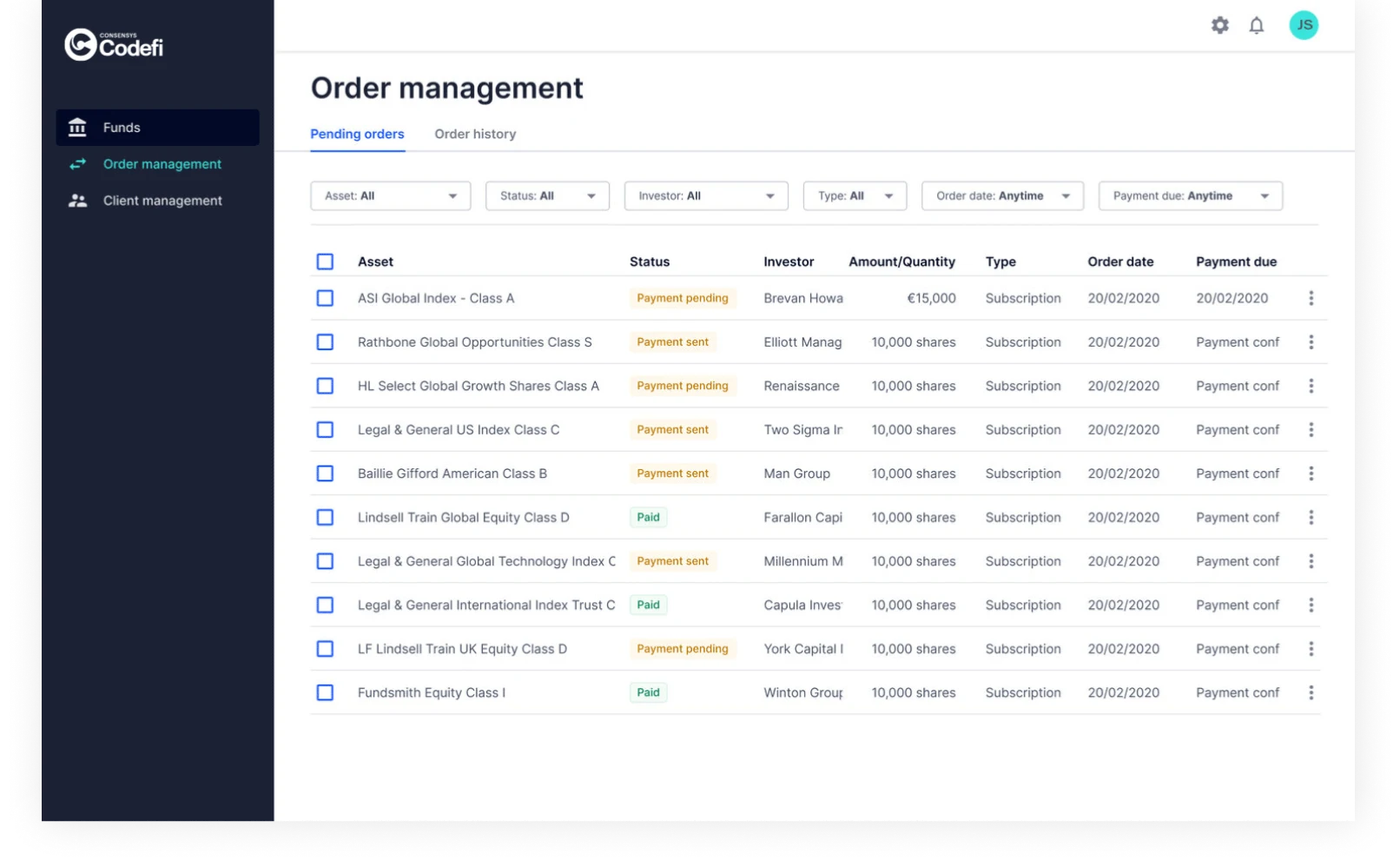

Expedite KYC and AML operations, set distribution rules, share compliance data with regulators and other network participants, and streamline auditing.

Unified Lifecycle Management

Automate digital security lifecycle events, facilitate governance activities, enhance investor relations, and enable portfolio and real-time cap table management.

Direct Asset Distribution

Distribute products directly to investors with peer-to-peer markets. Clear and settle transactions in real time with multiple payment options and no counterparty risk.

Accurate Performance Measurement

Retain a transparent and immutable history of transactions, view position and performance metrics, and generate actionable insights all from a single dashboard.

The Codefi Assets Sandbox

Grasping the impact and functionalities of digital assets can be challenging. However, first-moving financial players have already started to take advantage of these innovations.

Asset managers, investment banks, transfer agents, broker-dealers, central security depositories, registered investment advisors, and crowdfunding platforms across the globe have reached out seeking to better understand how the Codefi Assets platform will change the way they issue, distribute, and manage financial products.

In response, we created the Codefi Assets Sandbox—a testing platform that will allow financial institutions to assess and explore digital assets in a simulated digital ecosystem. The sandbox can be customised to the environment in which a financial institution operates, allowing experimentation, learning, training, and demonstration:

Experiment: Simulate digital asset issuance, distribution, and exchange.

Learn: Give access to team members who want to learn how Codefi Assets works and what it means to operate on a blockchain.

Train: Manage users, onboard investors, and create digital assets without the risks of real-world implementation until your team is ready.

Convince: Access product demos to showcase the features and benefits of the platform to your stakeholders.

For Developers

The Codefi Assets API

Integrate blockchain and issue digital assets while maintaining control over your product workflow. Deploy digital asset tokenization, issuance, and lifecycle management functionalities without building from scratch, hiring developer resources, or paying for smart contract audits.

Apply Codefi Assets functionalities to use cases beyond those supported by the Codefi Assets platform with the Universal Token for Assets and Payments.

FOCUSED MARKETS