CODEFI COMPLIANCE

AML-CFT Compliance for Ethereum-Powered Digital Assets

Build trust in digital assets with reliable AML and CFT solutions to protect against fraud and financial crime.

Overview

Trusted and Automated Compliance, Built on KYT

As the token economy continues to expand, regulatory compliance requirements will further intensify, and anti-money laundering (AML) and countering-the-financing-of-terrorism (CFT) activities will become non-negotiable.

Codefi Compliance empowers businesses to efficiently address rigorous regulations and avoid hefty penalties by delivering advanced compliance capabilities that include know-your-transaction (KYT) frameworks, high-risk case management, and real-time reporting.

Product Benefits

A game-changer for crypto exchanges, compliance firms, regulators, and the wider digital asset industry

Each year, financial institutions spend over $270 billion and dedicate 10-15% of staff to regulatory compliance obligations. Codefi Compliance uses the innovation of blockchain technology to reduce the back office costs of compliance management.

Operational efficiency

Cut through associated costs and processes with streamlined risk assessment tools.

Actionable insights

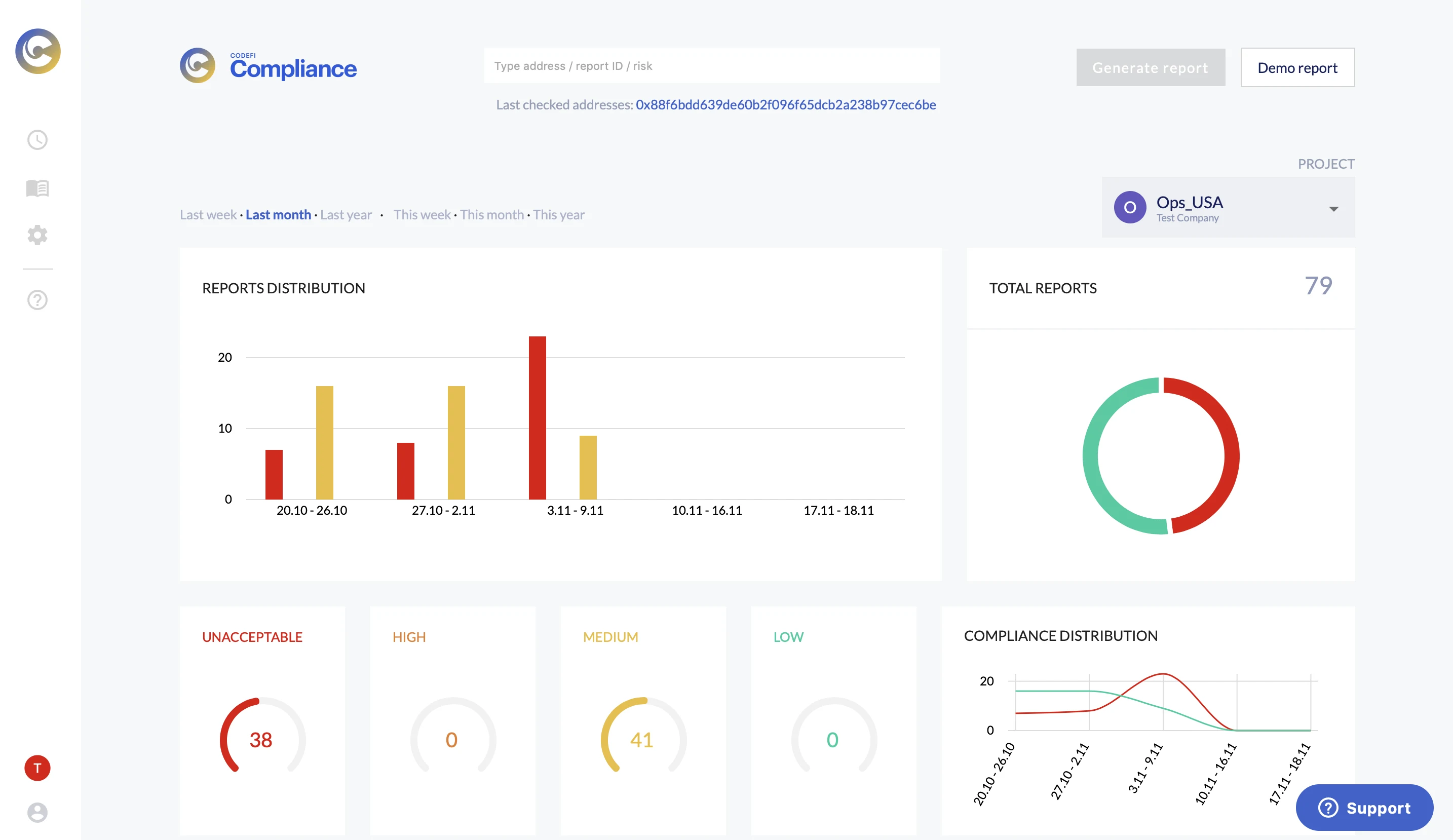

View trends, break down risk exposure levels, and investigate suspicious assets and transfers in deeper detail.

Unparalleled Ethereum expertise

Vast Ethereum coverage

Run reports for over 300,000 types of digital assets including major ERC standard tokens and stablecoins.

Even for new assets

Obtain compliance analysis for new Ethereum-based digital assets, in most cases within 24 hours.

Built for global operations

Customizable criteria

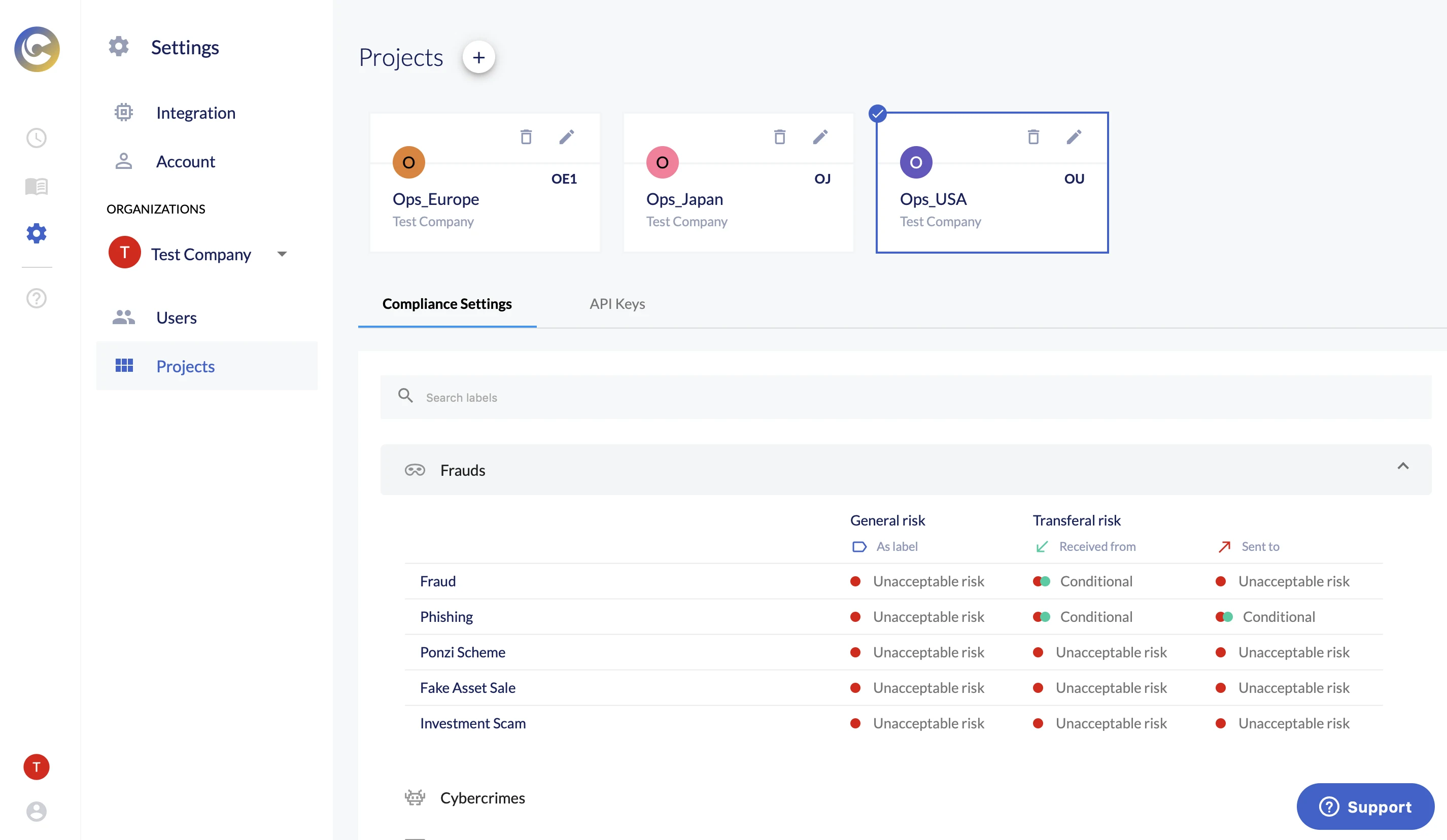

Facilitate global activities with multiple regulation configurations from a single access point.

Versatile settings

Follow FATF guidelines in any jurisdiction without interrupting process flows.

"We needed a crypto-AML solution that covered all ERC20 tokens, had flexible pricing options, and seamless integration. Codefi checked all the boxes. Codefi has been an important partner in giving regulatory bodies peace of mind that our product is meeting the highest of AML standards.”

Graeme Barnes

Product Manager at Sight

PRODUCT FEATURES

Compliance for next-generation commerce and finance

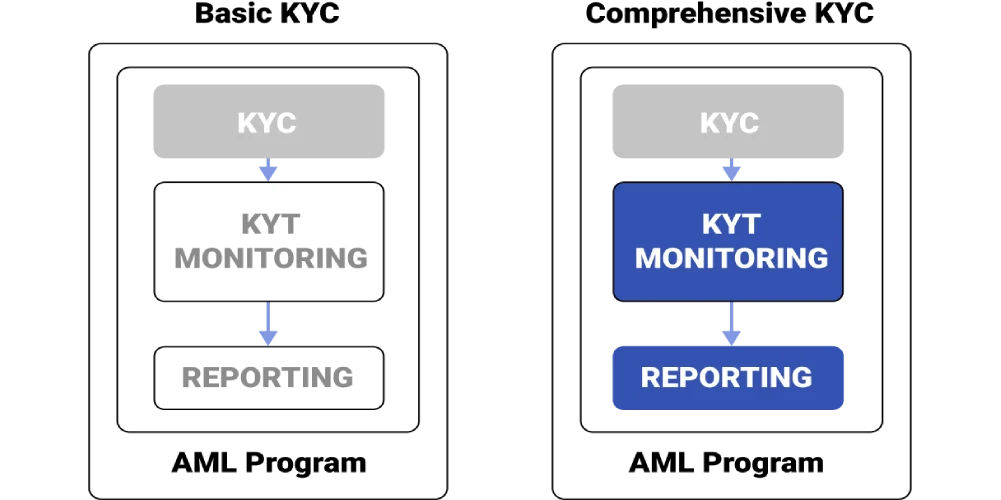

Compliance for next-generation commerce and finance AML and CFT compliance traditionally rely on know-your-customer (KYC) guidelines. But next-generation compliance analysis for decentralized infrastructure demands KYT capabilities which evaluate the behavior of participating addresses rather than participant identity. Our KYT process enables businesses to identify risky behaviors associated with money laundering, fraud, and corruption, while ensuring privacy around confidential transaction data.

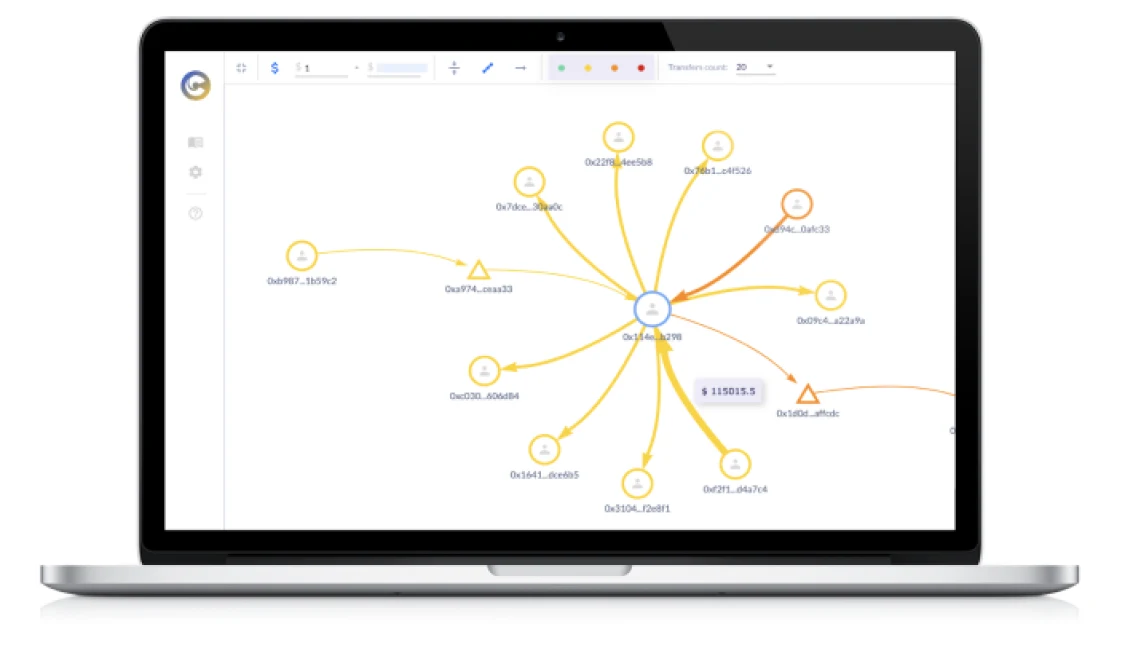

Codefi Compliance offers customizable risk assessment software that visualizes pseudonymous Ethereum on-chain data. Our AML-CFT checks involve advanced analytics of non-personally identifiable information (PII) data for risk management and regulatory compliance purposes.

Risk Management

Adjust compliance settings according to jurisdiction regulations. Manage multiple settings across international divisions to support global operations.

Risk Assessment

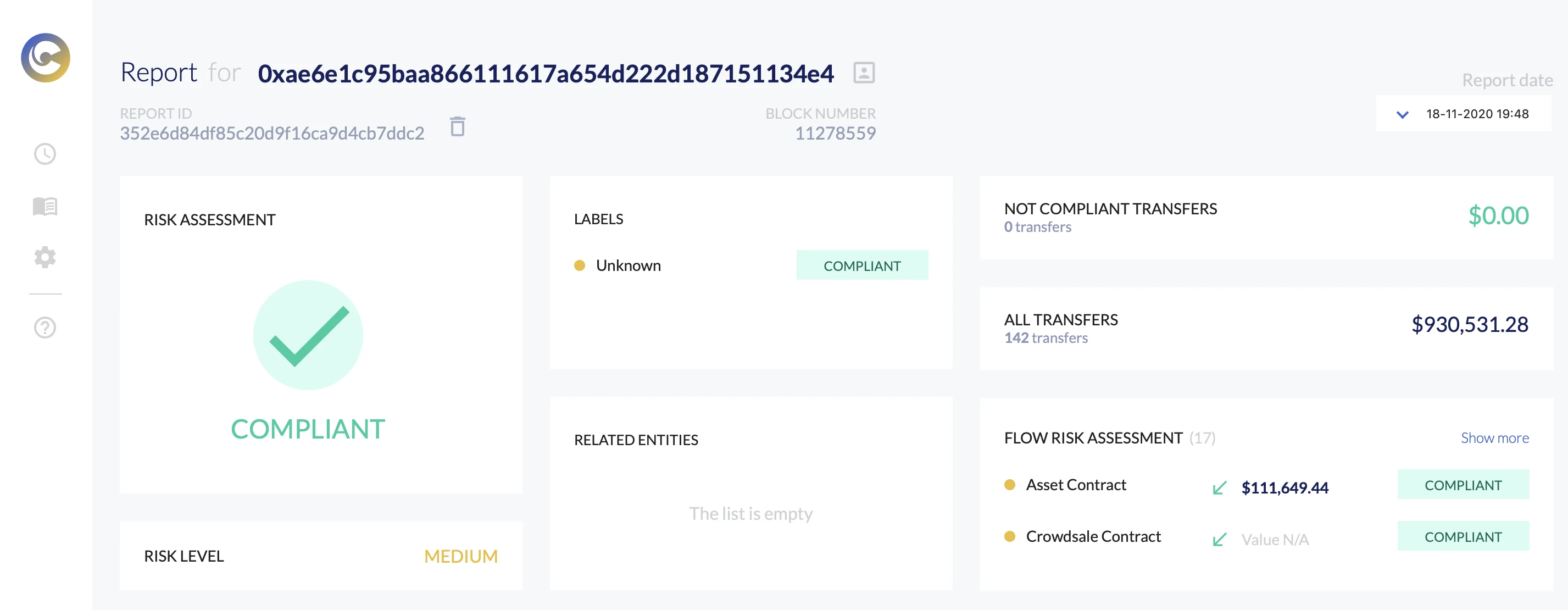

Generate real-time AML reports that include compliance and risk status for all your digital assets. Filter by labels, identified attributes, transaction compliance score, and risk levels.

Risk Investigation

Track platform activities, user behavior, transactions, and fund flow. Analyze data and spot trends to inform business strategy.

DeFi is a new set of rails for economic value to be created and exchanged. These rails have fostered many arrangements in a relatively short time—from peer-to-peer payment systems to automated loans to USD-pegged stablecoins—and offer a range of use cases for developers, individuals, and institutions. At Consensys Codefi, we believe that what started as a crypto native industry will evolve to become a dynamic ecosystem of different use cases for different participants with varying appetites for risk. For broad adoption to occur, many different types of operators, permissionless and regulated, must be able to interact with DeFi protocols.

Codefi Compliance was created for those using DeFi rails for regulated activity who need robust tools for compliance. For builders who want to create regulated offerings on DeFi and capital allocators who need tools to allocate capital, Consensys Codefi provides an AML-CFT tool to ensure organizations can safely engage with digital assets and comply with local regulations. Codefi Compliance increases access for a greater variety of organizations to participate in the DeFi revolution, helping to advance a more open, reliable, and digital economy on Ethereum.

INDUSTRY INSIGHT