Have you noticed that BNB (Binance’s token), HT (Huobi’s token), FTT (FTX’s Token), and OKB (OKEx’s token)—all the major exchange tokens—are linked to exchanges based in East Asia? This indicates that exchanges in that region are more willing to take regulatory risk in distributing their own token vs. western exchanges. Each exchange uses these tokens as a way to spur activity on their exchange, retain users, and attract new users.

There are some distinct tradeoffs between the various tokenomic designs of these exchange tokens. While all the tokens enable traders to receive discounts on trading fees, only BNB and FTT are utilized to boost referral fees. Binance and FTX have both seen the most amount of user growth, and this growth is driven by incredibly large referral networks.

Furthermore, only one of these tokens, HT, allows users to vote on what projects can actually be listed on the exchange. This functionality has an incredibly amount of value, as exchange listings are often market moving events.

Intrigued? Let's dive in further.

Overview

Binance is a cryptocurrency exchange that provides a platform for trading various cryptocurrencies. Binance is currently the largest exchange in the world in terms of daily trading volume.

BNB is the cryptocurrency coin that powers the Binance ecosystem.

Token Utility

Use BNB to pay for goods and services, settle transaction fees on Binance Smart Chain, participate in exclusive token sales and more.

Benefit

Save 25% on spot trading fees

Save 25% on margin trading fees

Save 10% on futures trading fees

Other rewards like greater commissions on referrals

Access exclusive token sales on Binance Launchpad (IEO platform)

Earn up to 40% commission via our referral program

Binance schedules quarterly BNB burns to permanently reduce the supply of BNB, in turn, increasing its value. The amount of BNB burned is calculated based on Binance’s overall quarterly trading volume. Quarterly coin burns will continue until a total of 100,000,000 BNB are destroyed, which represents 50% of the total BNB supply.

Stakeholder Roles

Can stake in the BNB vault to earn interest. BNB token holders can use BNB tokens to pay fees on the exchange, with the incentive being that Binance offers a rebate as an incentive for up to five years of membership.

Overview

FTX is a derivatives exchange. Additionally, they have other business lines, such as an emergent NFT market.

Token Utility

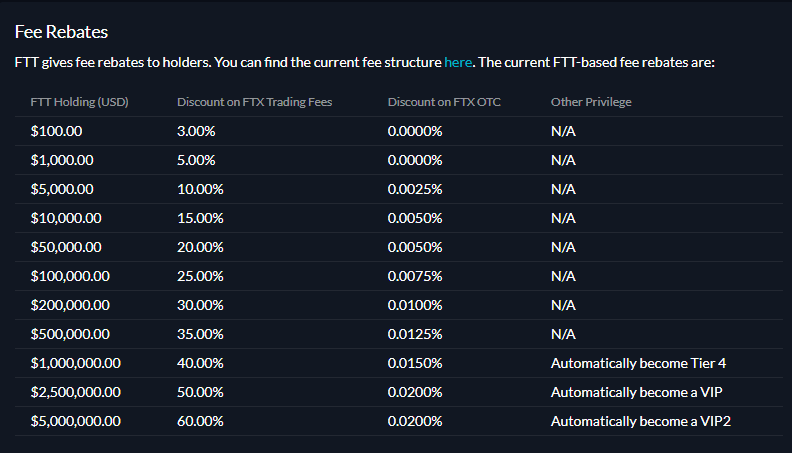

FTX Token (FTT) is the backbone of the FTX ecosystem, providing fee rebates to holders. The team have designed incentive schemes to increase network effects and demand for FTT, and to decrease its circulating supply. Staking FTT provides a myriad of benefits, expanded on below

Benefit

Rebates is the largest benefit, in addition to the stakeholder roles below.

Staking FTT gives the following benefits:

Increased referral rates: referrers that stake FTT are paid a higher fraction of their referees' fees

Maker fee rebates: stakers get maker fee rebates (in addition to the standard FTT fee discounts)

Free swag NFTs: stakers can spin the non-fungible swag wheel for a chance to win a free NFT, redeemable for FTX-themed swag or resellable at the NFT marketplace.

Bonus votes: stakers get bonus votes in our polls (in addition to the standard number of votes, based on FTT held and trading volume)

Increased airdrop rewards: stakers get increased SRM airdrops (and potentially later other airdrops and yield)

Waived blockchain fees: stakers get a number of free ERC20 and ETH withdrawals per day

IEO tickets: stakers get tickets for IEOs hosted in FTX

33% of fees generated on FTX markets are used to buy FTT and then subsequently burn the token

FTT is bought and burnt every week

Stakeholder Roles

Users hold and/or stake FTT for the benefits highlighted above.

Overview

Huobi is a publicly listed Hong Kong cryptocurrency exchange where users can trade a range of cryptocurrencies. Huobi China also operates a blockchain consulting and research platform.

HT is Huobi’s native cryptocurrency token.

Token Utility

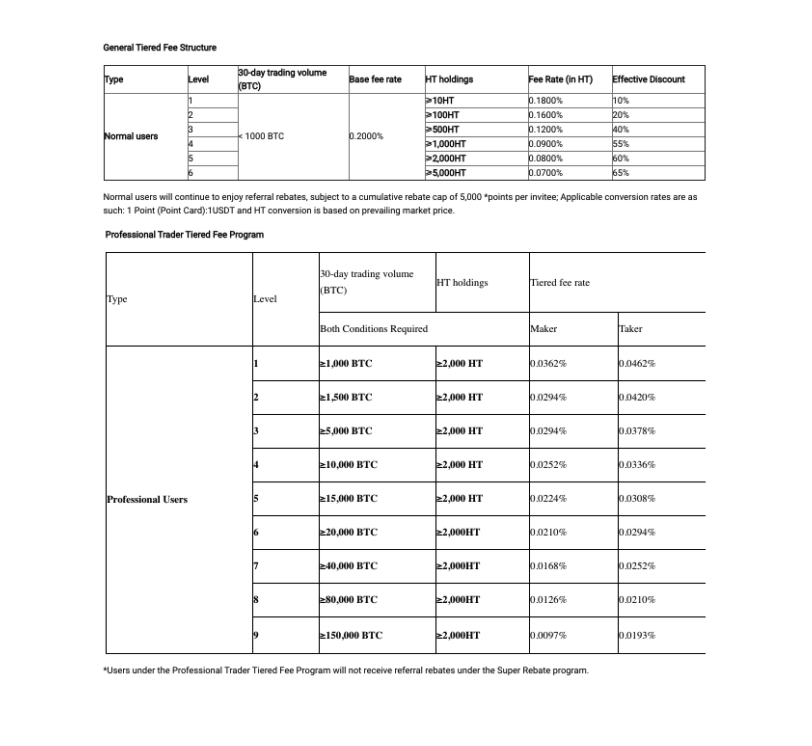

The HT token, short for Huobi Global Ecological Token, can be used within Huobi and the Huobi ecosystem to provide users with discounts on trading fees, access to new cryptocurrencies, and the ability to vote on decisions concerning the future of the platform. In addition, token holders can benefit from holding the HT token as a store of value, if they believe that Huobi will increase in value over time.

Benefit

The Huobi token runs on the Ethereum network, enabling exchange on any ERC-20 network

Users with VIP statuses receive discounts whilst trading the token (see appendix for details on how to qualify as a Huobi VIP)

Huobi apportions tokens to the investor protection fund to insure users who fall victim to manipulative schemes or experience financial losses

Holders have exclusive voting rights on the platform, empowering them to influence exchange and listing decisions

Asset-creating projects can benefit from holding the token, as it provides them the opportunity to vote for their asset to be listed on the exchange

Huobi minted 500 million Huobi tokens, with 60% distributed to members of the exchange (particularly those who purchased packages) and 40% reserved in Huobi’s custody. Half of the reserved tokens are to be used to reward loyal users, and the other half has been reserved for rewarding Huobi team members.

Huobi also operates a deflationary model for the HT token supply with 15% of profits being burnt, and 5% being used to buyback and burn the team’s tokens.

Overview

OKEx is a cryptocurrency exchange platform for trading cryptocurrencies, with core features including spot and derivative trading. The OKB token is used for a range of features within the OKEx ecosystem.

OKEx also hosts the OKExChain (OEC), a trading chain built on blockchain technology and designed to be used to trade, own, and control any on-chain assets.

Token Utility

The OKB token can be used to access special features within the exchange, to calculate and pay trading fees, to reward users, and to provide access to voting and governance on the platform. In addition, it is the currency of the OKEx ecosystem, playing a fundamental role in OKEx’s architecture and development.

Benefit

Save up to 40% on trading fees

Access to OKEx Earn (a suite of five passive income products: (1) liquidity mining with DeFi tokens, (2) savings, (3) staking, (4) staking on Ethereum 2.0, and (5) C2C loans)

Access to Jumpstart token sales for new crypto projects on the platform

Acts as the currency for the OEC ecosystem

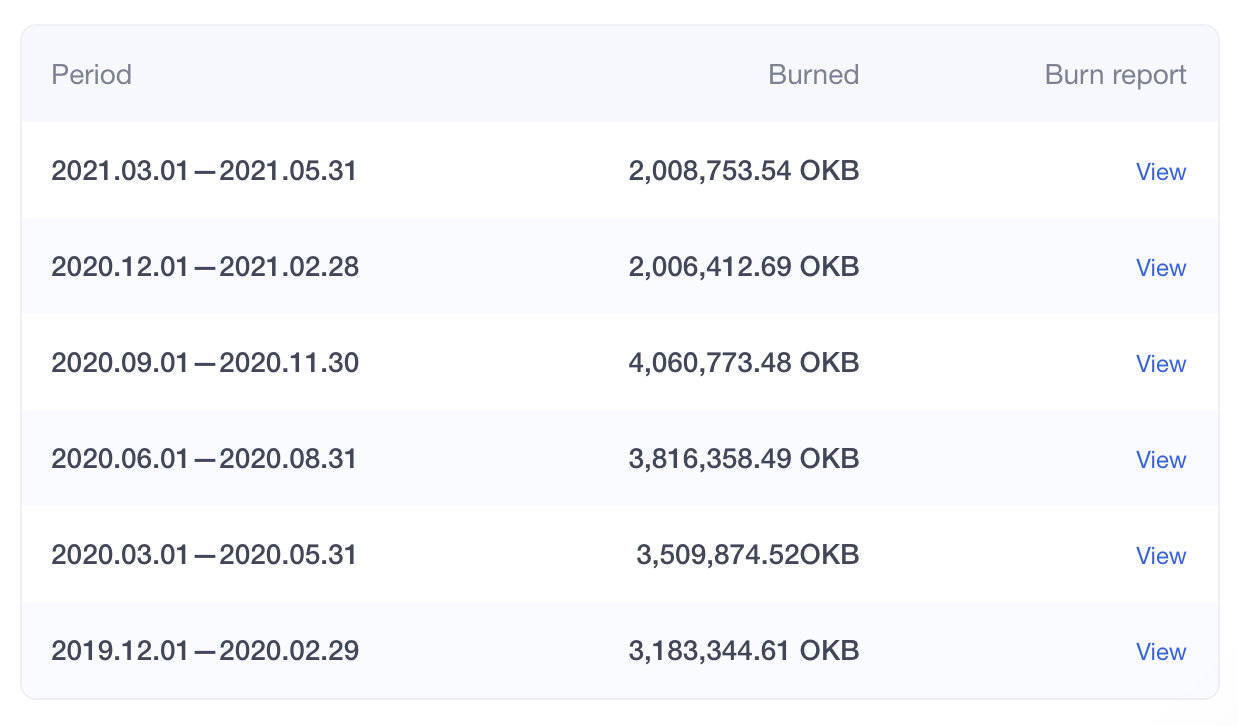

Originally, 300 million OKB tokens were minted, with a portion of these burnt every 3 months to reduce the supply. This is done by using 30% of the income from OKEx spot trading fees to buy-back OKB for burning. Tokens are burnt by sending them to a burning address that no one can access.

About MetaMask Institutional

MetaMask Institutional offers unrivaled access to the DeFi ecosystem without compromising on institution-required security, operational efficiency, or compliance requirements. We enable funds to trade, stake, borrow, lend, invest, and interact with over 17,000 DeFi protocols and applications.

MetaMask Institutional periodically releases Institutional DeFi research. This includes the following:

A weekly governance newsletter summarizing the most important governance events across major DeFi protocols.

A monthly report covering the different token economics—tokenomics—of projects within a specific subcategory of crypto.

In the future, we will leverage proprietary data to present new shifts in adoption within the crypto ecosystem, and we will host private investor roundtables covering investment theses and projects building in the space.

Want to receive these insights? Apply to join MetaMask Institutional's Early Adopter Programme.